China Energy Transition Review 2025

China’s surge in renewables and whole-economy electrification is rapidly reshaping energy choices for the rest of the world, creating the conditions for a decline in global fossil fuel use.

Hi, Sam here. I'd like to share Ember's latest publication: China's Energy Transition Review, for which I was a contributing author.

The report contains many interesting data points and perspectives that I'd encourage diving into. You can find the full report here.

Below I include a few key charts and findings.

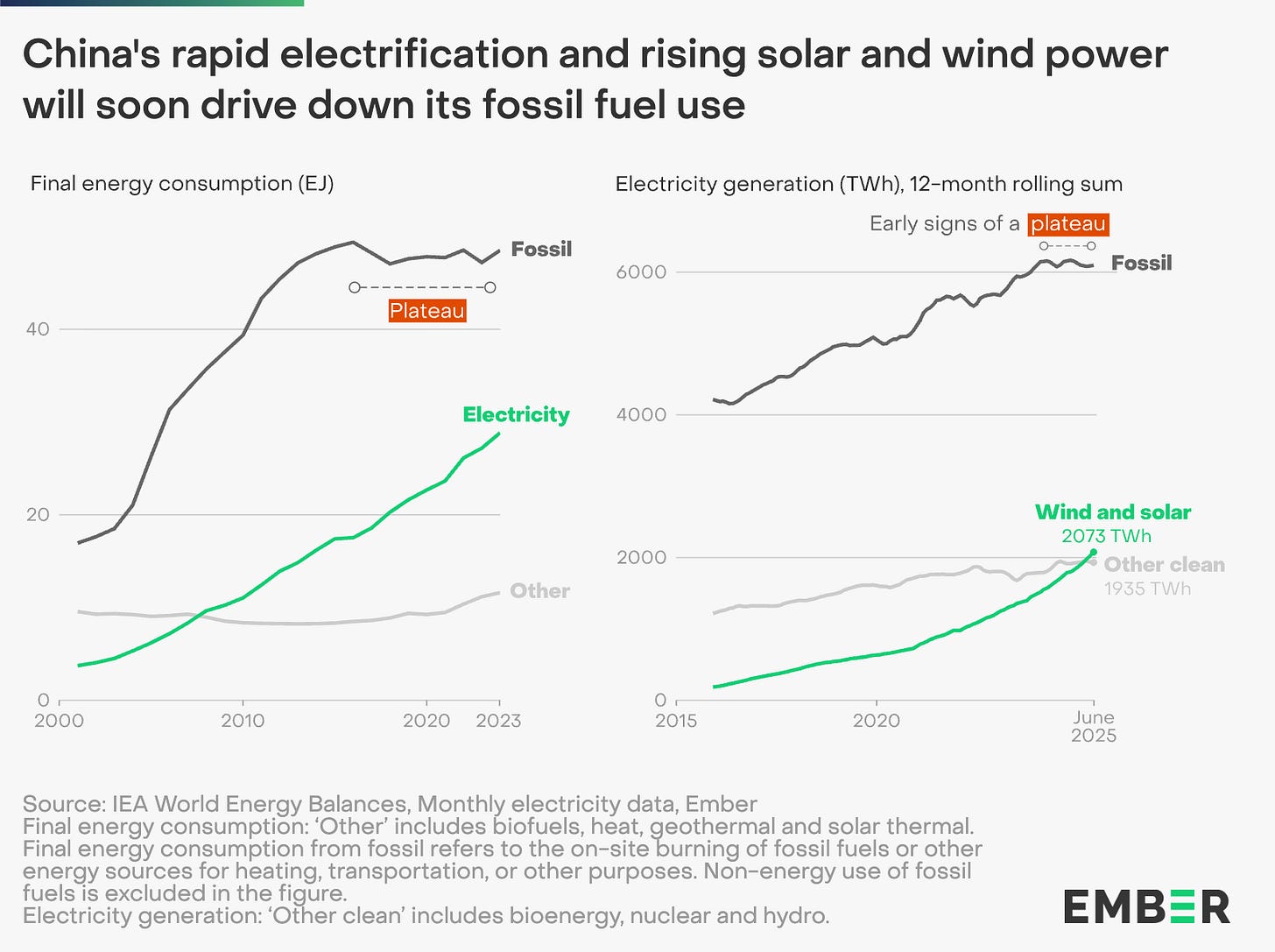

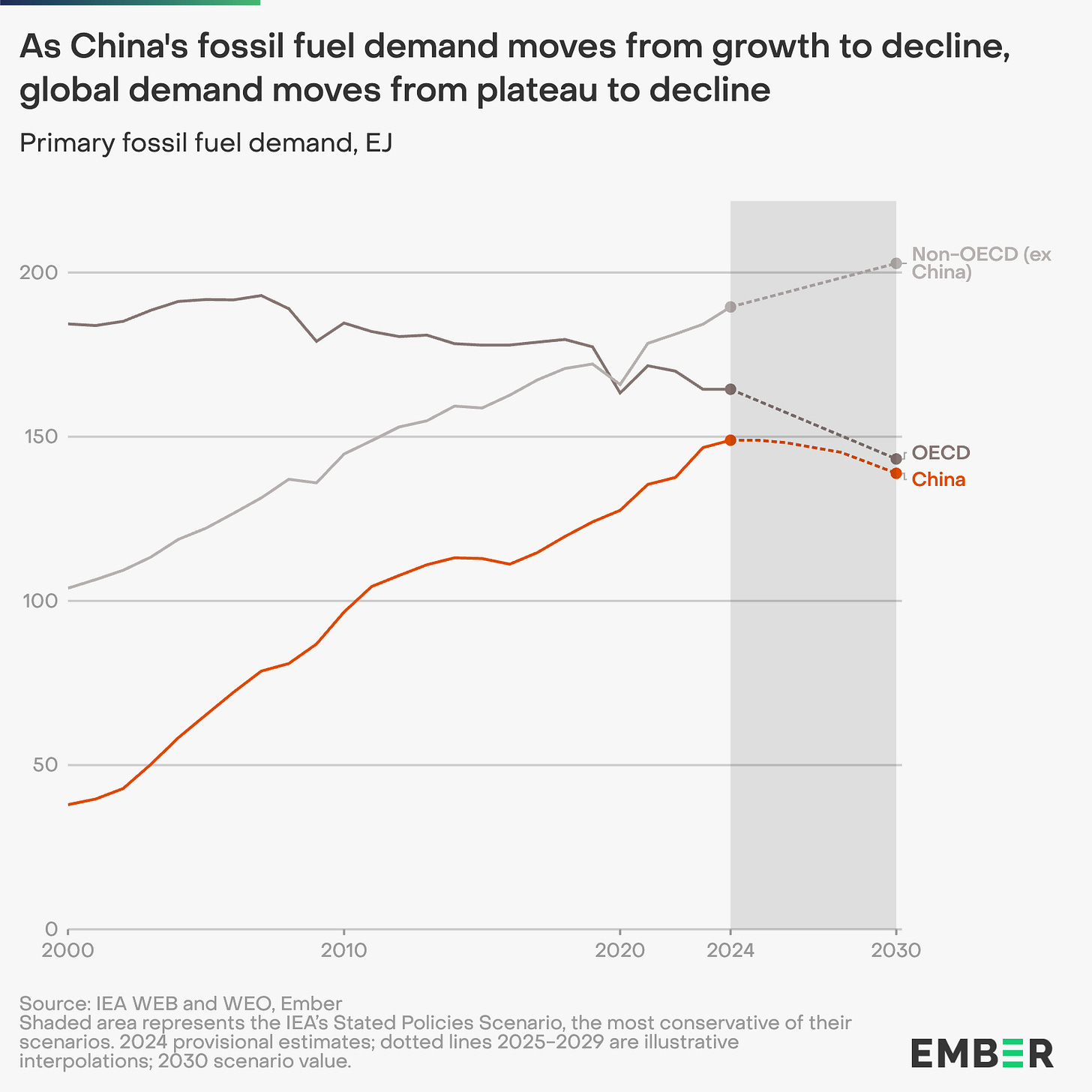

Fossil fuel demand is plateauing in China. Rapid progress across the twin trends of renewables and electrification is driving a plateau in fossil fuel demand.

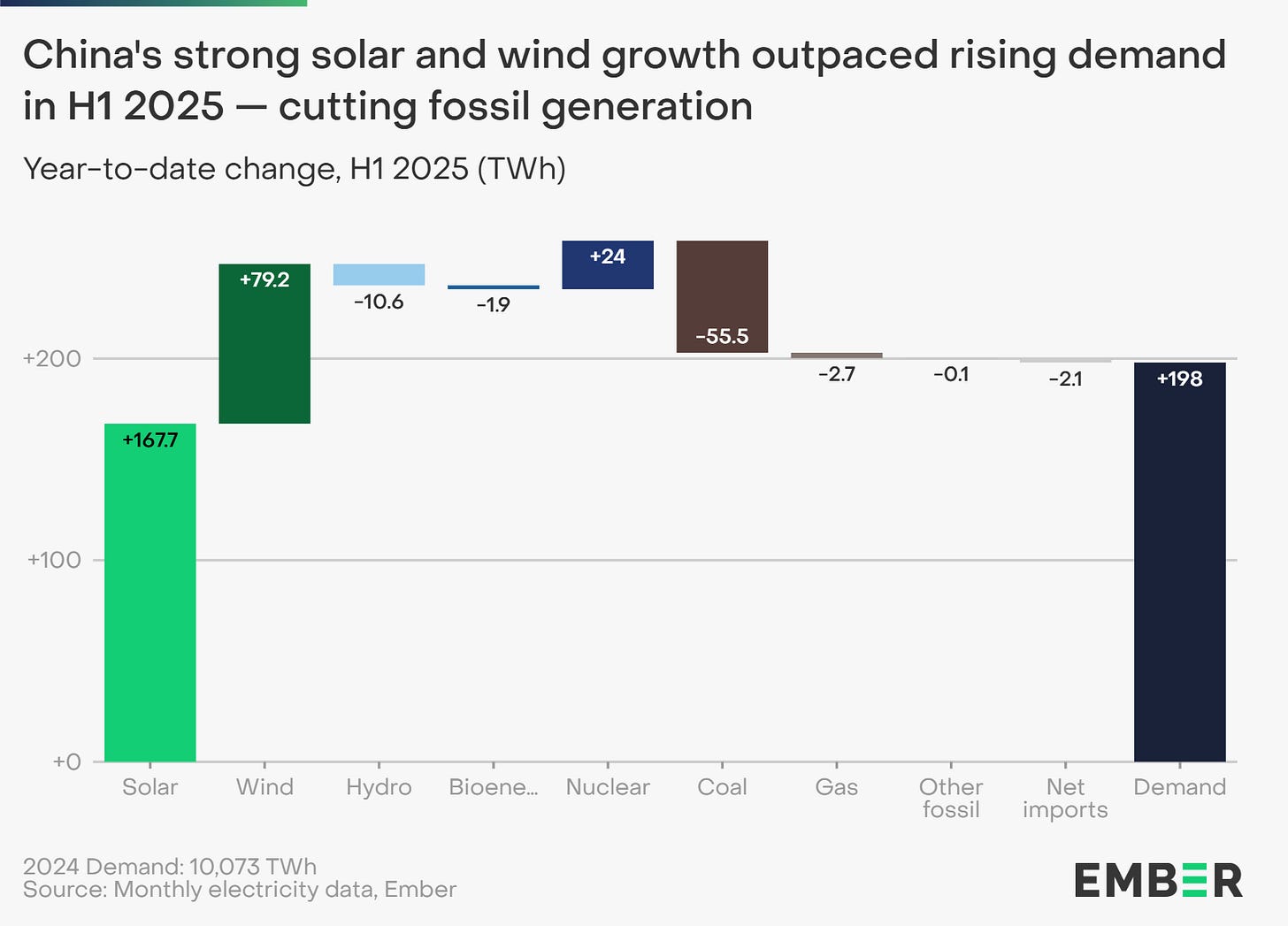

Fossil-fuelled generation is down in H1 2025 – a sign of what’s to come. Solar and wind meet all growth in electricity demand in the first half of 2025 to drive a decline in fossil generation.

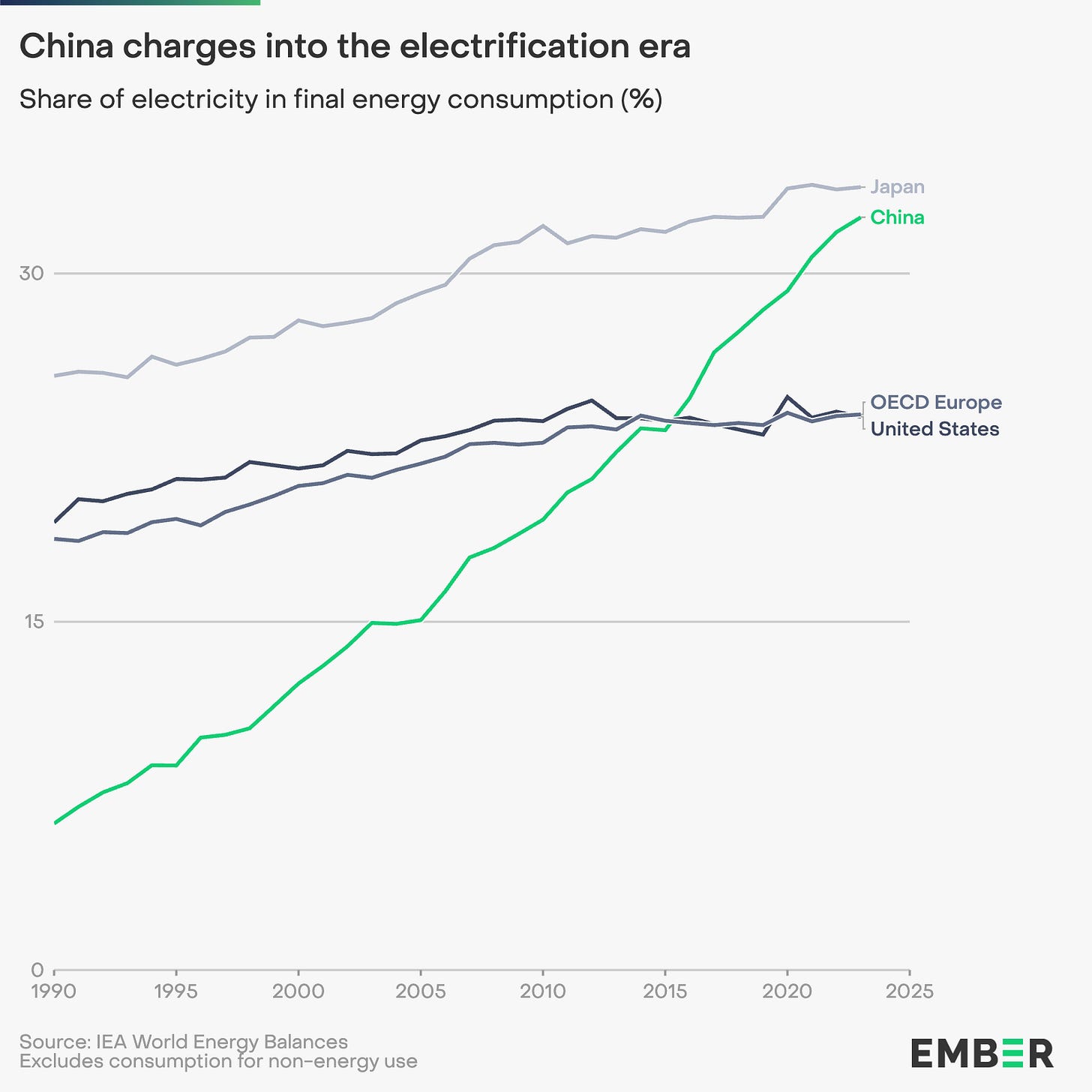

China is electrifying its end-use rapidly. By contrast, electrification in OECD-Europe and the United States has been flat for a generation.

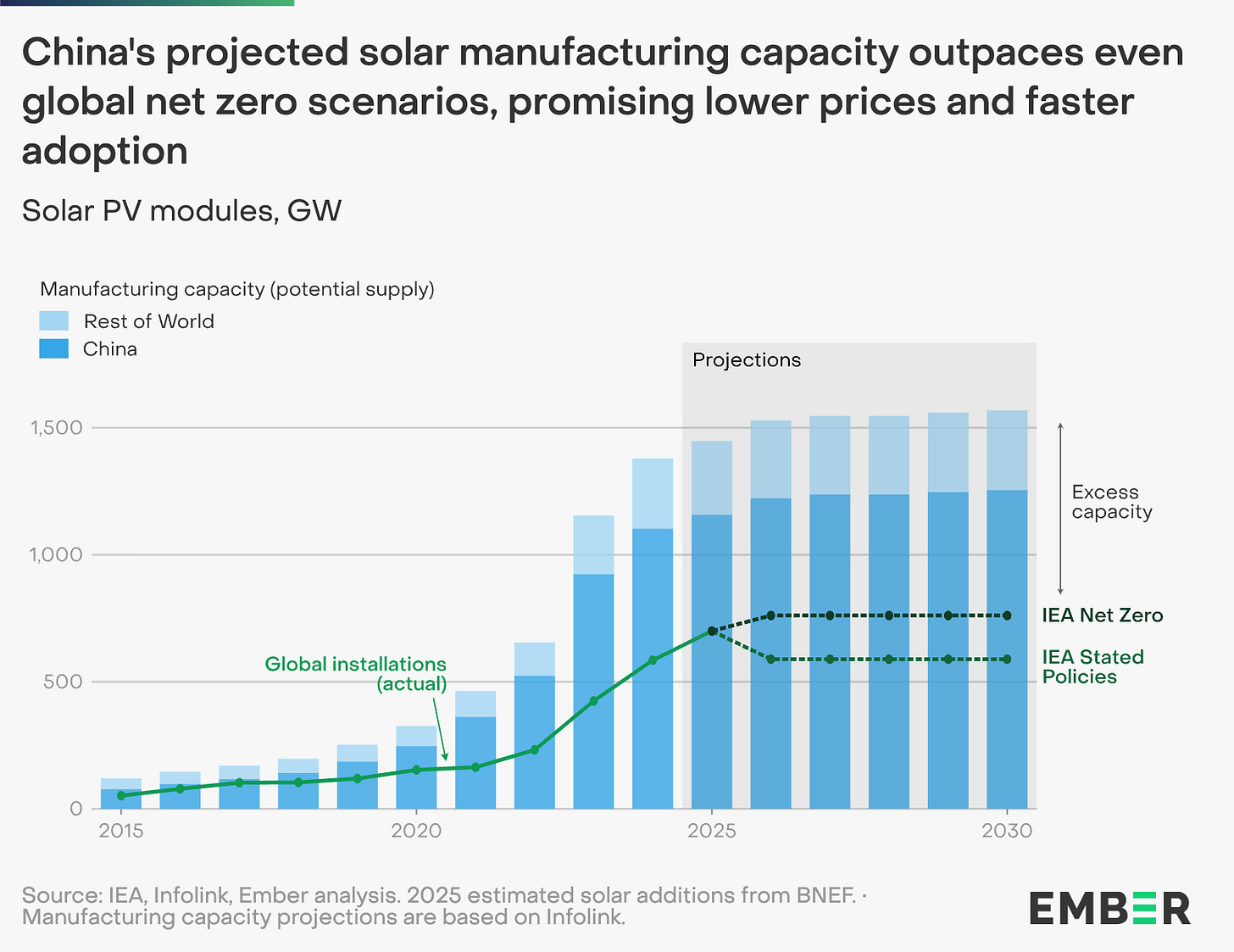

China has built out massive manufacturing capacity. China's massive supply-side capacity in solar and batteries outpaces even global net-zero scenarios into the near future, promising lower prices and faster adoption both inside and outside China.

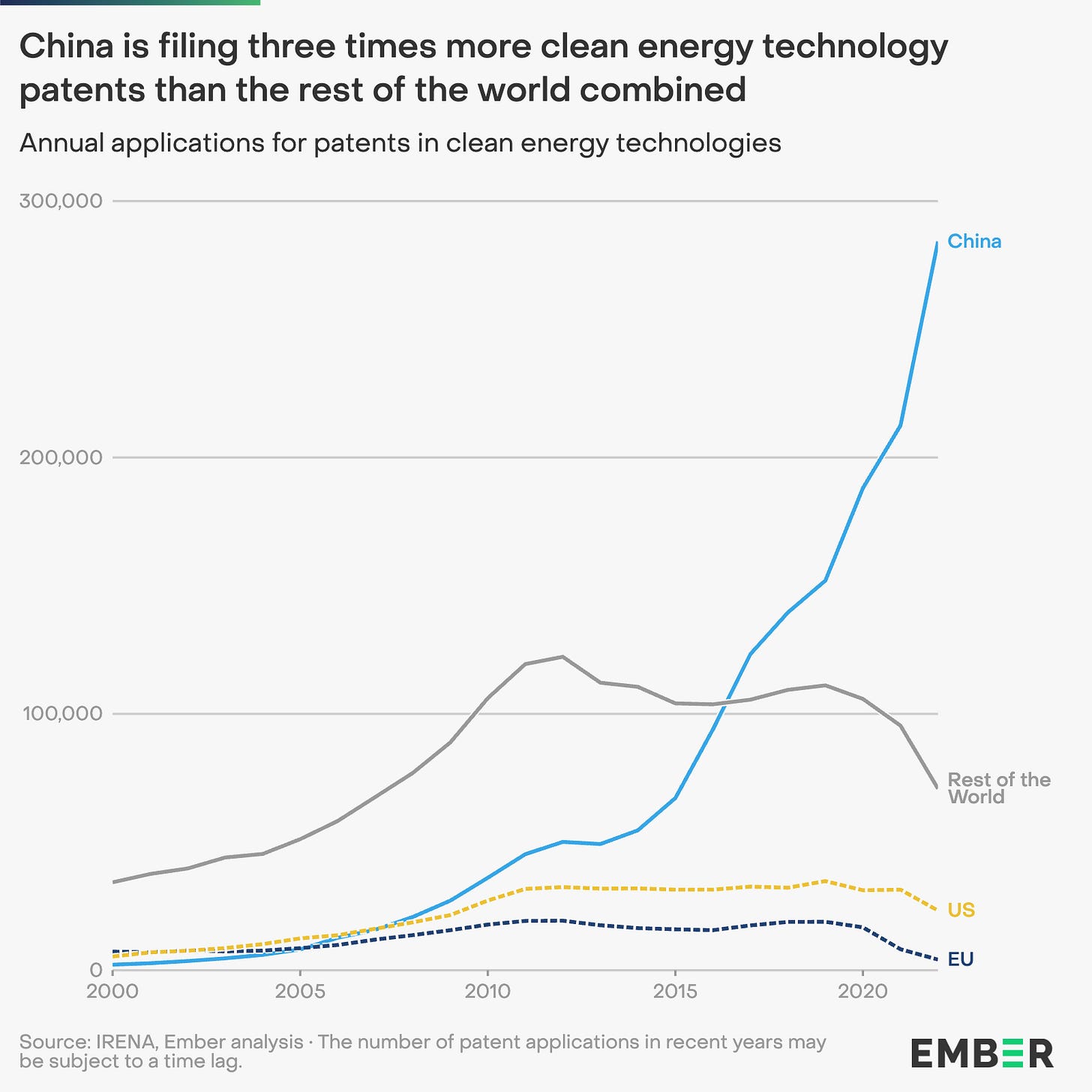

Beyond manufacturing electro-technologies at scale, China has emerged as the principal innovator in the energy transition. Its share of patent applications has soared from about 5% in 2000 to about 75% in recent years.

Made-in-China electro-technologies are rushing into emerging markets. For example:

China's solar exports tripled in five years, reaching 242 GW in 2024, with around half going to emerging markets

Where solar goes, batteries follow. In 2024, China exported $61 billion worth of batteries, with a quarter going to emerging markets

EV exports to emerging markets surged from $0.5 billion in 2020 to $16.5 billion in 2024, overtaking the EU

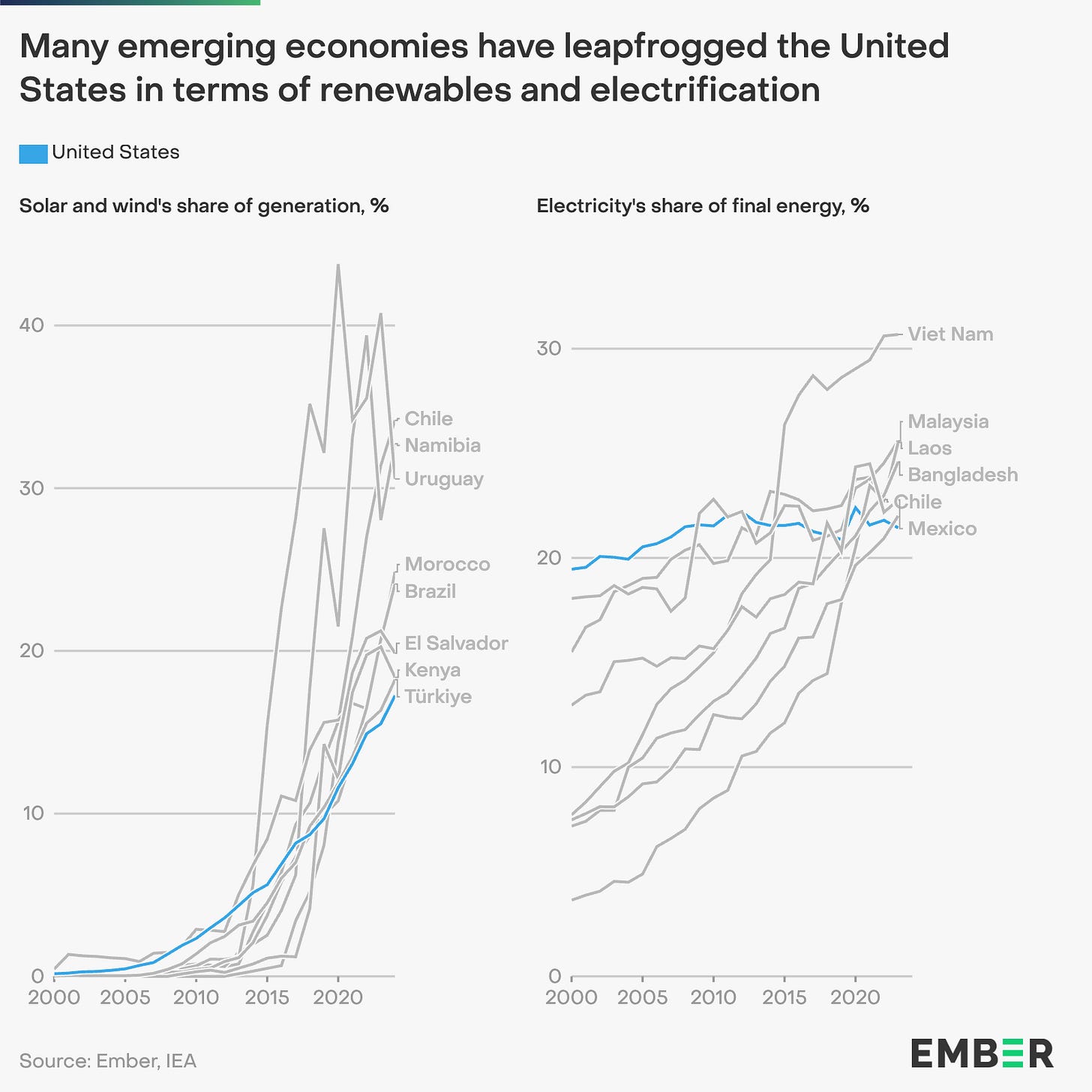

The result is that many emerging markets are leapfrogging the United States in renewables and electrification:

63% of emerging markets (by energy demand) have higher solar uptake than the US, and 25% of emerging markets have leapfrogged the US in end-use electrification.

China pivots global fossil fuel demand. Since 2018, declines in OECD countries have offset rises in non-OECD excluding China, making China the pivot nation in the global fossil fuel demand. As China moves from growth to decline in fossil fuel consumption, so too will the world.

In the IEA's Stated Policies scenario, China's fossil fuel demand begins falling by 2030. Given China's track record of exceeding targets – hitting its 1,200 GW solar and wind goal six years early and its EV target of 20% of sales 3 years early – these projections will likely prove conservative. The accelerating momentum of emerging market leapfrogging only reinforces this outlook.

Find the full report here. We’ll also have more to come on China’s role in the wider electrotech revolution in our annual slide deck, published next Tuesday 16th September.

Hey Sam,

Thank you for a thorough analysis! I look forward to reading the report.

I was curious to get your take. What was the most compelling finding for you from the research?

For me, it is compelling to see China in this new light as a country pushing for the use of renewables, from being one of the top polluting countries in the world. I remember discussing China's pollution output in environmental science class. Sure, it has not necessarily dropped dramatically, but it is compelling just to see a plateau! Regardless of motivation, it is a demonstration of what is possible with a commitment to renewables, and not having funding swing from fossil fuels to renewables and back again in a four to eight-year cycle. I am not advocating that Canada adopt a new political system, but just highlighting the advantage of not having the swinging pendulum of funding in energy align with political views.

The other finding that really stood out for me was the number of emerging markets that China was exporting to, or in other words, making allies with, if they were not allies already.

Thank you again, and have an amazing day!

Isn’t China still building new coal plants?

And why no mention of nuclear? Aren’t they building a ton of those too?